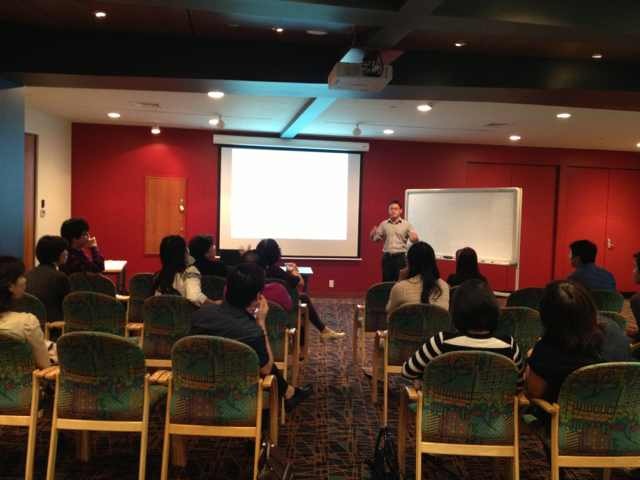

The Accounting and Tax Seminar went successful. Thank everyone for your time to attend. It was nice to make new friends and exchange ideas. It was a very brief presentation about the Tax entities in New Zealand, and the Tax type analysis, each individual slides would worth doing a separate seminar for.

But the time was not allowed, therefore, please keep an eye on our website for future seminars on the breakdown of the interesting topics, and if you would like to learn other topics, please drop me an email or call me so that I can prepare for the next session.

Again, thank you for coming on last Saturday, and I was so overwhelming by your attendance.

Jerry Li